ExNova

ExNova Review - Is It the Right Choice for You? [...]

ExNova Review - Is It the Right Choice for You? [...]

IQ Option has become a leading online trading platform worldwide, [...]

365 trading platform 365Trading trading using a trading platform called [...]

Ayrex trading platform Which is different from most other brokers [...]

OptionFair trading platform The trading platform proposed by OptionFair was [...]

BinaryTilt trading platform BinaryTilt chose to offer a trading platform [...]

Welcome to the largest expert guide for binary options and online binary trading BinaryOptions.net. It has been educating traders worldwide since 2011 and all our articles are written by professionals who make a living in the financial industry and online trading. More Profitable in 2020 No matter what level of experience you have, if you want to discuss trading or brokers with other traders we also have the largest forum in the world with more than 20,000 members and have Lots of daily activities, read on to start trading today!

quick link

Compare Bonuses Brokers Low Deposit Demo Accounts

Robots and car trading , tactics , scams

Binary Options is a quick and easy financial tool that allows investors to predict whether the price of an asset will rise or fall in the future, such as Google stock price, Bitcoin price, USD/GBP exchange rate or gold price. The interval can be as little as 60. Seconds make it possible to trade hundreds of times a day in global markets.

Before you place a trade you know how much you will earn if your prediction is correct usually 70-95% – if you invest $100 you will be credited $170 – $195 on the successful trade. Success This makes risk management and trading decisions a lot easier, the result is often a yes or no answer – you win all or you lose all – hence the “binary” option. It’s well known in advance, and this structured payout is one of its attractions.

There are now exchange-traded binaries, which means that traders are not trading with a broker.

To start trading you need a regulated broker account, select one from the list of recommended brokers which only includes brokers that have been shown to be trustworthy, top brokers are selected as the best choice. for most traders

If you are new to binary options, you can open a demo account with most brokers to try their platform and see what it’s like to trade before you deposit real money.

These videos will guide you through the concept of binary options and how to trade them. If you want to know more details, please read this entire page and follow the links to all the more in-depth articles. Binary trading doesn’t have to be complicated. But as with any topic you can educate yourself to perfect your expertise and skills.

The most common type of binary options is “up/down” trading, however, there are different types of options. One common factor is that the result will have a “binary” result (yes or no).or some types available:

Below is a step-by-step guide to trading binary options:

Options fraud has been a major problem in the past, with fraudulent and unlicensed operators exploiting binary options as a new and exotic derivative. These are fortunately disappearing as the controllers have finally begun to act. But traders still need to look for regulated brokers.

Note!Do not trade with any broker or use the services listed on our blacklists and scams page.Stick to what we recommend here on the site.Here are shortcuts to pages that can help you determine the right broker for you:

The number and variety of assets you can trade varies from broker to broker, most brokers have options on popular assets such as major forex pairs which include EUR/USD, USD/JPY and GBP/USD as well as Major stock indices such as FTSE, S&P 500 or Dow Jones Industrial, commodities including gold, silver, oil are generally available.

Individual stocks and equities can be traded through many binary brokers, not all of them are available. But generally you can choose from around 25 to 100 popular stocks such as Google and Apple.

The asset list is always clearly listed on all trading platforms and most brokers list the full asset on their website, this information is also available in our reviews as well as currency pairs.

The expiry time is the point at which the trade is closed and settled. The only exception is where the option ‘touches’ reaches a predetermined level before expiration. The expiration of any trade can range from 30 seconds up to a year. While binaries started out with very short expirations, demand has been confirmed that there is now a large selection of timeframes available, some brokers also give traders the flexibility to set their own specific expiration times.

Expirations are generally divided into three categories:

While it was slow to react to binary options at first, regulators around the world are beginning to regulate the industry and make them feel. Some of the major regulators today include:

There are also regulators operating in Malta and the Isle of Man. Several other entities are now focusing on binaries, particularly in Europe where regulators in the country are keen to support CySec regulation.

Unregulated brokers are still operating and while some are reliable, the lack of regulation is a clear warning sign for potential new clients.

Recently, the ESMA (European Securities and Markets Authority) has moved to ban the sale and marketing of binary options in the EU, however the ban only applies to brokers regulated in the EU. Trading Options: First of all, they can trade with an unregulated company, this is a very high risk and it is not advisable to choose a company. Some unregulated, responsible and honest. But many places are not like that.

The second option is to use a company regulated outside the EU ASIC. In Australia it’s a strong regulator – but they won’t implement a ban.This means ASIC regulated companies can still accept EU traders.See our broker list for regulated brokers or trusted in your region

There is also a third option, traders who register as ‘professional’ will be exempt from the new ban, the ban is designed to protect ‘retail’ investors only, professional traders can continue trading at EU regulated brokers such as IQ Option, to be classified as professional, account holders must meet two of the following three criteria:

We have many detailed guides and strategy articles for both general education and specialized trading techniques, below are some tips to get you started if you want to learn the basics before you start trading, from Martingale to Rainbow, You can find more volume on strategy page.

For more reading about signals and reviews of different services visit the signals page.

The ability to trade different types of binary options can be achieved by understanding some concepts such as strike price or block price, settlement and expiration date.

When the trade ends, the behavior of the price movement according to the selected type determines whether it is profitable (in money) or a loss position. (From money) Also, price targets are key levels that traders set as a benchmark for setting results, we will see the use of price targets when we explain the different types.

There are three types of trades, each with a different format.

Let us take them one by one.

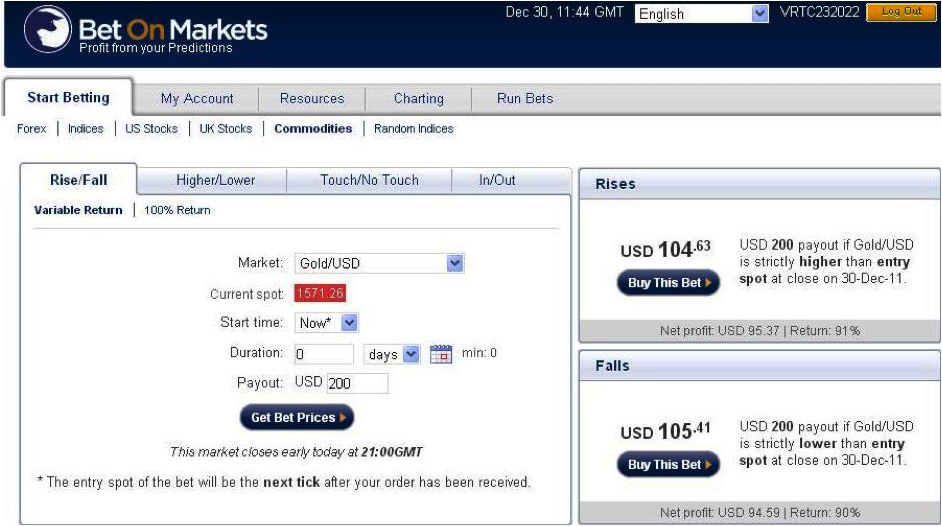

Also known as an up/down binary trade, its essence is the prediction that an asset’s market price will end up higher or lower than its strike price. If the trader expects the price to go up (trade “Up” or “High”), he buys a call option if he expects the price to fall (“Low”). or “Down”), he will buy a put option. The expiration time can be as low as 5 minutes.

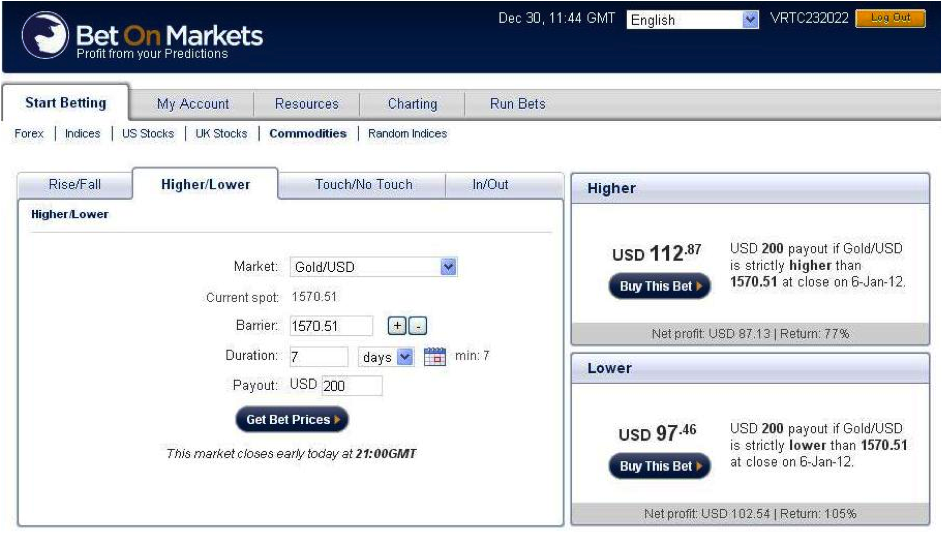

Please note: some brokers hold/down a different type where the trader buys a call option if he expects the price to be higher than the current price or buys a put option if he expects the price to be lower than the current price. You may see this as rising/falling type on some trading platforms.

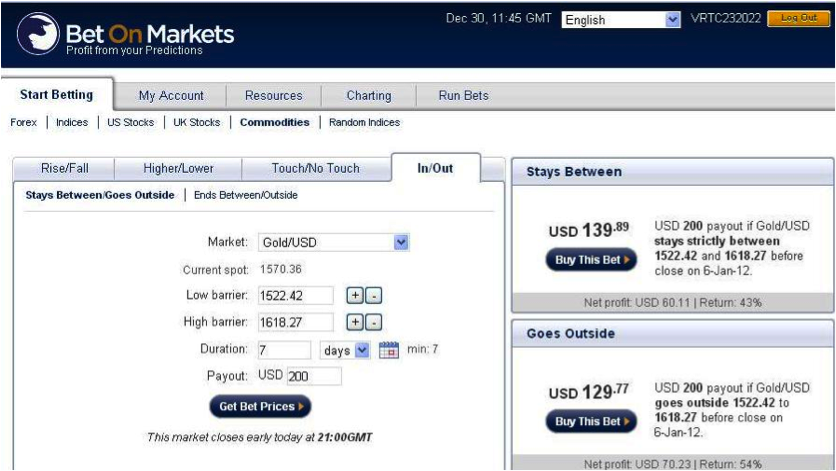

The In/Out type, also known as “tunnel trade” or “boundary trade”, is used for price consolidations (“in”) and breakouts (“out”). Set two price targets to create a price range fromThen he buys an option to predict if the price will stay within the range/tunnel until expiration (In) or if the price will break the range in either direction (Out).

The best way to use binary channels is to use asset pivot points, if you are familiar with pivot points in forex you should be able to trade this type.

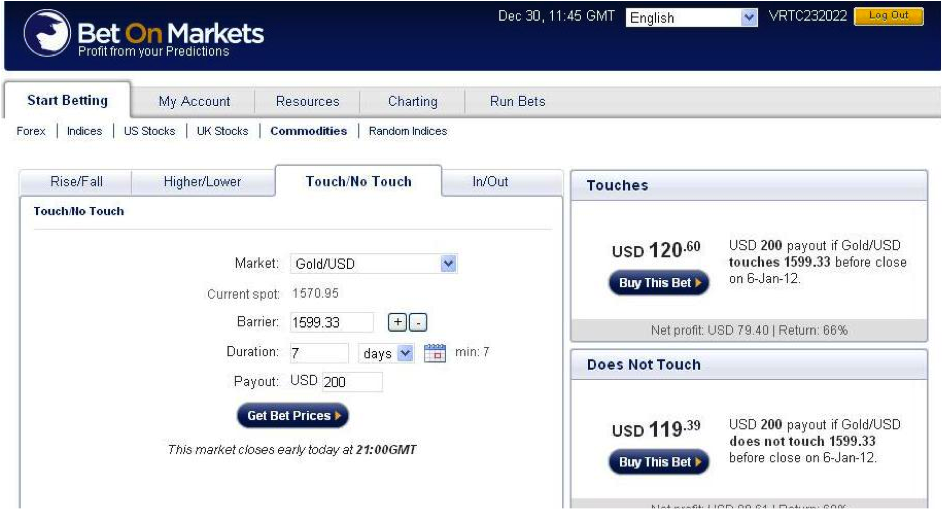

This type is pre-specified about whether the price movement touches the price or not. The “touch” option is the type in which the trader buys a contract that will deliver a profit if the market price of the purchased asset touches at least one predetermined price target. times before expiration if the price action does not touch the price target. (strike price) before expiry, the trade ends in loss.

“Untouched” is the opposite of “untouched”. Touch Here you are betting on the price movement of the underlying asset that has not touched the strike price before expiration.

There are variants of this type that we have Touch and Double No Touch. Here the trader can set two price targets and buy a contract that bets on the price that touches both targets before expiration (Double Touch) or No Touch. Both targets before expiration (Double No Touch). You will normally execute a Double Touch trade when there is severe market volatility and the price is expected to have several price levels.

Some brokers offer all three types while others offer two and offer only a wide range of offers.In addition, some brokers also limit expiration dates in order to get the best of the different types. It is advisable to shop for a broker that will give you maximum flexibility in terms of types and expiry times that can be set.

Trading via your mobile has been made very easy as all major brokers provide fully developed mobile trading apps, most trading platforms are designed with mobile device users in mind. So the mobile version is very similar if not identical to the full web version on the original website.

The broker supports both iOS and Android devices and produces a version for each device.Downloads are quick and traders can register through the mobile website as well.Our reviews have more details on each broker’s mobile app. But most of them know that this is a growing trading area, traders want to react immediately to news events and market updates, so brokers provide tools for clients to trade wherever they are.

“Binary Options” means, in simple terms, trades where the result is a ‘binary’ yes/no response. These options pay a fixed amount if they win. (known as “in the money”), but the entire investment is lost if the binary trade disappears, so in short they are a form of fixed return financial options.

Steps in stock trading through Binary Options;

The steps above are the same for every broker, more layers of complexity can be added. But when trading stocks the simple Up/Down trade type is still the most popular.

A call and put is just a requirement to buy or sell an option, if the trader thinks the underlying price will increase in value, they can open a call, but where they expect the price to fall, they can take the trade.

Different trading platforms label their trading buttons differently, some even switch between Buy/Sell and Call/Put, others drop the used phrase and make the call altogether. It is absolutely clear in which direction the trader opens the option.

As a financial investment vehicle, they are not deceiving themselves. But there are untrustworthy and dishonest brokers, robots and signal providers.

The point is not to write the concept of binary options based on dishonest brokers, the image of these financial instruments is affected by these operators. But regulators are slowly starting to prosecute the perpetrators and adapting to the industry. Our forums are a great place to raise awareness of any wrongdoing.

These simple checks can help anyone avoid scams:

Binary trading strategies are unique to each trade, we have a strategy section and have ideas that traders can try out, technical analysis is available to some traders combined with charts, indicators and price action research. Money management is essential to ensure that risk management is applied to all trades, different styles will suit traders and different strategies will evolve and change.

There is no single “best” strategy. Traders need to ask questions about their investment goals and risk appetite and then learn what works for them.

This will depend on the trader’s habits, if there is no strategy or research then any short-term investment will win or lose based solely on luck, on the other hand, a well-researched trader will make sure they do. Do everything you can to avoid relying on good luck.

Binary options can be used for betting. But they can be used to trade based on expected value and profit, so the answer to the question comes down to the trader.

The main benefits of binaries are the clarity of risk and reward and the structure of the trade.

If you trade forex or its volatile cousins crude oil or spot metals such as gold or silver, you will learn one thing: these markets are very risky and easy to get blown out of the market. Things like Leverage and profit margins, news events, price moves and re-quotes, etc. can negatively affect the trade, the situation is different in binary options trading, there is no leverage at all. Phenomena such as slippage and re-quotes do not affect binary options trading results, thus minimizing the risk of binary options trading.

The binary options market allows traders to trade financial instruments in the currency and commodity markets as well as indices and bonds. This flexibility is unmatched and educates traders on how to trade the markets. These are one stop shop to trade all these tools.

Binary trading outcomes are based on one parameter: direction. Traders are betting on whether the financial asset will end up in a given direction. Additionally, traders are free to check when the trade ends by using the Set an expiration date This is a trade that started badly, chances are it will end well This is not the case with other markets. Loss control, for example, can only be achieved using a Stop Loss, otherwise the trader will have to endure pull-outs if the trade has a poor return in order to provide a profitable opportunity. Simple points do. The point here is that in Binary Options, the trader is less concerned if he trades with another market.

Traders have better control over trading in binary, for example if a trader wants to buy a contract he knows in advance what he expects to gain and what he will lose if the trade runs out of money. another market For example, when a trader places a pending order in the forex market to trade high impact news, there is no guarantee that his trade will be filled at the initial price or trade. that lose will be closed loss

Payouts per trade are usually higher than binary with other forms of trading. Some brokers offer payouts of up to 80% for trades, this can be done without damaging the account. In other markets, such payouts can happen if the trader disregards all money management rules and thus has capital. Many trades enter the market hoping for one big payout.

To trade the highly volatile forex or commodities market, the trader must have a reasonable amount of money as trading capital, for example trading gold, which is a commodity with high volatility for 10,000 days or more during periods of time. High volatility requires tens of thousands of dollars of trading capital.However, binary options have less entry requirements as some brokers allow people to start trading with as low as $10.

Payouts for trading Binary Options are greatly reduced when the odds for a successful trade are very high, although it is true that some trades offer payouts of up to 85% per trade. But high payouts are only possible when trading with a set expiry at some distance from the date of the trade, of course, in this situation the trades become more unstable.

Some brokers do not offer truly useful trading tools such as charts and features for technical analysis to their clients, experienced traders get this by providing these tools elsewhere. New to the market is not fortunate, this is changing for the better as operators grow and realize the need for these tools to attract traders.

Unlike in forex where traders can get accounts that allow micro and micro trades, in micro accounts many binary options brokers set up a trading floor that allows traders to trade the minimum amount of money in the market. It is easy to lose too much capital when trading binaries as a forex broker may allow you to open an account with $200 and trade micro lots which only allows the trader to disclose the amount of capital that is acceptable in the market. Try hard to find many binary brokers that will allow you to trade below $50 even with a $200 account. In this situation, four losing trades will cause the account.

Unlike other markets where the risk/reward ratio can be controlled and set in order to gain an advantage in winning trades, binary options odds skew the risk/reward ratio.

When trading markets such as forex or commodity markets, it is possible to close the least losing trade and open another profitable one if a re-analysis of the trade reveals. that in the event that binaries are traded against exchanges this is minimized.

These are two different alternatives with two different psychology trade-offs. But both can be used as investment tools, one is more time centric and the other is more price centric, they both work in time/price but the focus you can get from one to the other. One is an interesting separation. Spot Forex traders may overlook time as a factor in trading which is a very big mistake. Successful binary traders have a very balanced time/price view. More binaries by their nature force one to exit a position within a certain time frame win or lose which instills a greater focus on discipline and risk management in forex trading this lack of discipline is the cause. #1 for the failure of most traders as they will suspend losing positions for a long time and reduce winning positions for a shorter period of time in binary options which is not possible when the expiration time is reached. Your trade will win or lose, below are some examples of how it works.

The above is a trade that happens to buy EUR/USD in the price range and time under 10 minutes. Spots focusing on the price regardless of the time component becomes an issue, the psychology of being able to focus on the limits and this dual core will help you in becoming a better trader overall.

The huge advantage of spot trading is the same failover – exponential gains from the price of 1 point. This is to say if you enter a position that you believe will increase in value and the price has not yet more But speeding to the downside, the normal trend for most spot traders is to wait or worse add to losing positions. The acceleration in time in the opposite direction it wants leaves most of the spot traders trapped in an unfavorable position because they do not plan the time to reason and this leads to a lack of Wisdom. implications in trading completely

The nature of Binary Options forces a more complete idea of trading out both Y = Price Range and X = Time Limit, they too will make you a better overall trader from the start. On the other hand, on the flip side, they by their very nature require a greater win rate as each bet means profit. 70-90%s 100% loss, so your win rate has to be on average 54%-58% to break even.This balance causes many traders to trade or take revenge trades that are not as good as holding/adding to losing positions as a spot forex trader. emotional control

In conclusion, when starting out as a binary trader, there may be a better foundation to learn trading. The reason is simple: focusing on time/price combinations is like looking both ways when crossing the road. The average forex only looks at price, which means he looks in one direction before crossing the road. Learning to trade taking both time and price into consideration should help a lot in building a trader overall.